Money View Personal Loan: If you are looking for an instant personal loan with minimal documentation and quick approval, Money View Personal Loan is one of the best options in India. It offers fully digital loan processing, flexible repayment options, and competitive interest rates — making it ideal for salaried and self-employed individuals.

Money View Personal Loan Overview

| Feature | Details |

|---|---|

| Loan Name | Money View Personal Loan |

| Provider | Money View Finance Pvt. Ltd. |

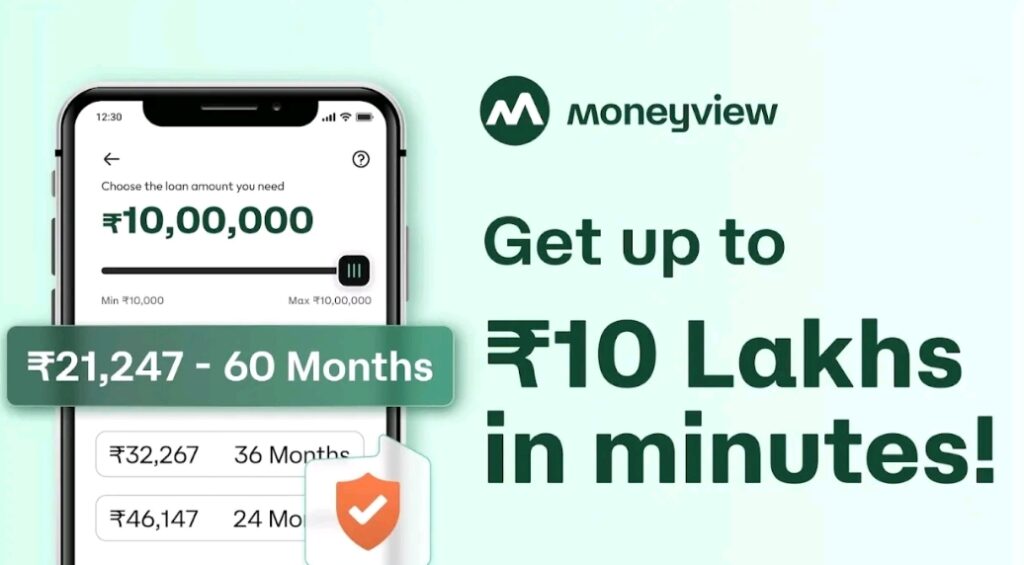

| Loan Amount | ₹10,000 – ₹10,00,000 |

| Interest Rate | Starting from 1.33% per month (16% p.a. onwards) |

| Repayment Tenure | 3 months to 5 years |

| Processing Fee | 2% to 8% of the loan amount |

| Credit Score Required | Minimum 650 (CIBIL or Experian) |

| Application Mode | 100% Online |

| Disbursement Time | Within 24 hours after approval |

| Official Website | www.moneyview.in |

What is Money View Personal Loan?

Money View Personal Loan is an unsecured loan designed for quick access to funds without the need for collateral. Borrowers can use it for various purposes like medical expenses, travel, home renovation, education, debt consolidation, or any emergency requirement. The entire process—from application to disbursement—is paperless and handled through the Money View app or website.

Key Features and Benefits

- Instant Approval & Disbursal:

Loan approval within minutes and disbursal within 24 hours directly to your bank account. - Flexible Loan Amount:

Choose from ₹10,000 to ₹10 lakh depending on your eligibility and requirement. - No Collateral Needed:

Completely unsecured loan, so no need to pledge assets. - Simple Online Process:

Apply anytime through the Money View mobile app or website. - Custom EMI Options:

Flexible tenure up to 60 months to suit your monthly budget. - Transparent Charges:

No hidden fees; all charges are clearly mentioned before loan approval

Eligibility Criteria

To apply for a Money View Personal Loan, you must meet the following conditions:

- Age: 21 to 57 years

- Employment: Salaried or self-employed

- Minimum Monthly Income: ₹13,500 (for salaried) / ₹15,000 (for self-employed)

- Credit Score: 650 or above (CIBIL/Experian)

- Bank Account: Active Indian bank account with regular income flow

Documents Required

Money View requires minimal documentation:

- Identity Proof: Aadhaar card / PAN card / Voter ID / Passport

- Address Proof: Aadhaar card / Utility bill / Passport

- Income Proof: Salary slips or bank statements for the last 3 months

How to Apply for Money View Personal Loan Online

- Visit the official website www.moneyview.in or download the Money View App.

- Click on “Apply Now” and fill in basic details like name, mobile number, and income.

- Check your eligibility instantly.

- Upload the required documents online.

- Choose your preferred loan amount and tenure.

- Accept the offer and receive funds directly in your bank account within 24 hours

Interest Rate and EMI Example

| Loan Amount | Tenure | Interest Rate (p.a.) | Approx. EMI |

|---|---|---|---|

| ₹50,000 | 12 months | 16% | ₹4,523 |

| ₹1,00,000 | 24 months | 18% | ₹4,992 |

| ₹2,00,000 | 36 months | 20% | ₹7,422 |

EMI Calculator

You can use the Money View Personal Loan EMI Calculator on their website to calculate your monthly installment before applying. This helps plan your repayment smartly

Why Choose Money View Personal Loan?

- Quick, paperless approval process

- Available for low credit score applicants (minimum 650)

- Trusted by millions of users across India

- Transparent policies and flexible repayment options

Important Tips Before Applying

- Always check your credit score before applying.

- Compare loan offers from multiple lenders.

- Repay EMIs on time to maintain a healthy credit record.

- Read all terms and conditions carefully.

Customer Support

- Official Website: www.moneyview.in

- Email: care@moneyview.in

- Mobile App: Available on Google Play Store

Conclusion

Money View Personal Loan is an excellent choice for individuals seeking a fast, easy, and secure loan without collateral. Its transparent process, quick disbursal, and affordable interest rates make it one of India’s most preferred online loan platforms in 2025.